Cell Phone Tower Lease Rates

Cell Tower Rental Lease Rates

The most frequent question asked by our clients is, “What is the maximum rent I can get for my property?” This is similar to, “What determines the price of my home?” Of course, home price is affected by size, quality, neighborhood, age, style, color, upkeep, comparable sales, etc. The same is true with cell tower lease rates. However, there is much more complexity when it comes to a cell tower lease because it involves many factors contributing to the wireless carrier’s network.

Why Is A Cell Site Needed?

From carriers’ requirements, carriers design new sites and provide to the real estate department to acquire a site location meeting guidelines. In many instances, site candidates are adequate selections to trigger the leasing team into action. The team performs homework by reviewing title reports to see who owns what property, assess how difficult it may be to interact with some of these owners (IBM, Bureau of Land Management, or Farmer John Smith). The leasing specialist will study property title reports, make initial contact with property owners, arrange some site visits with other staff to ascertain which of the properties would be best for the designs. This designation is important.

What Determines Cell Tower Lease Rates

Whether a negotiation is for a cell tower lease renewal of an existing cell site or a new “greenfield” (never before existing) site, rent rate is usually the first concern raised by our wireless landlord clients. Therefore, we will provide the major factors that influence wireless rent rates to help landlords understand how monthly cell tower rent rates are determined:

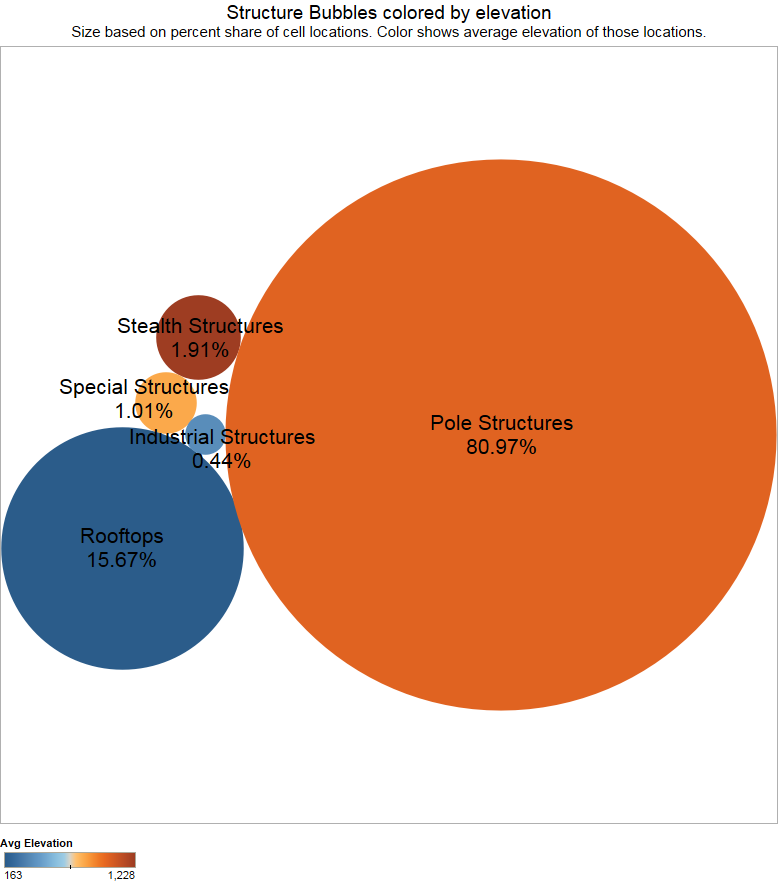

Rooftop Cell Sites of Commercial Buildings

Are the cell tower antennas installed on your commercial building rooftop? This is called a “rooftop” cell site and it’s one of the best options for a cell tower lease. Another installation type is a “raw land site” (see below). While technically, a rooftop cell site is not a cell tower site, landlords often use “cell tower” to describe both rooftop and raw land sites. Rooftop sites tend to command higher rent than raw land sites do. This is because the wireless carrier does not have to build a tower to support their antenna facilities. Without having to build the tower, wireless carriers save money in tower maintenance, insurance, tower climbers (very risky and expensive work), FAA lighting, liabilities, risks, etc.

Additionally, rooftop sites tend to be concentrated in the metropolitan areas where there are plenty of tall buildings to choose from. It is also much harder to gain jurisdictional zoning approvals in metropolitan areas, so rooftop sites often are the only choices available to wireless carriers. Rooftop installations do have their own degrees of complexities, including structural analysis to guarantee that the roof can handle the intense weight of the equipment (thousands of pounds in a few square feet), drilling through the roof, waterproofing, etc. These engineering challenges do not exist in raw land site tower builds. With increased demands and interruptions to the building’s structures, building owners can often demand more rent for rooftop lease rental rates than cell tower lease rates.

Cell Towers on Raw Land Sites

The most common form of cell site construction is a steel structure built on land leased from property owners. The leased space for a celltower lease is usually an area from 20’x20′ to 40’x40′ square. These represent the most common spaces leased from wireless carriers and tower companies to install a cell tower, electronic cabinets, power and telco cabinets, fenced in to limit access to wireless carrier personnel only. Raw land sites require the wireless carriers to build a steel structure tall enough to support the antennas heights required by the engineers. The most popular tower types are monopoles, lattice towers, guyed towers, flag poles, and stealth sites (disguised to look like naturally existing structures (tall pine trees, cactus, a giant boulder, church steeple, etc.). Tower sites tend to command lower cell tower lease rents than rooftop sites because (1) they tend to be in the outskirt of towns with less vehicular or residential density compared to larger city population concentrations and (2) they are generally more expensive to develop and build than rooftop sites. There are exceptions to both of these points, but they are presented as a “rule of thumb.”

Where People Live

Cell site locations near populations is a good sign that landlords can command more lease rental revenue than more remote areas. If a cell site location is near major metropolitan areas,then cell tower lease rates will clearly be higher due to the value of the site to the wireless carriers. For example, downtown Manhattan, NY leases can command higher rents, while downtown Boise, Idaho can command much less per month. In its simplest form, a cell site can process more calls, handle more internet traffic, and is cheaper to maintain in a highly populated area than in rural locations. For these reasons, wireless carriers are willing to pay high lease rates. It is also reasonable to expect that real estate costs are higher in downtown areas than in rural areas, so it is not surprising that major metropolitan areas do get higher rent rates than in rural areas.

Locations

Often, places such as shopping malls, stadiums, airports, and convention centers can host a large amount of people in a very limited space. These events tend to drive a tremendous amount of data consumption by cell phone users through the use of video uploads, emails, messaging, photo sharing, etc. that would overload any cell towers. For that reason, all wireless carriers must have special overlay systems that can handle venue-related cell phone data and voice traffic demands. Landlords with properties closest to popular venues tend to command higher cell tower lease rents than average.

To support this high concentration of users, wireless carriers build in-building cell antenna systems internal to the building structures to cover cell phone traffic from the inside of these concrete and steel structures

. But there must be an equally significant system external to these venues to support the same number of people entering and leaving these venues. A 60,000 person venue must have cell traffic capacity for 60,000 people inside the stadium, and 60,000 people outside the stadium as the same people bus, drive, park, and walk to and from the facilities. In-building systems are often negotiated with facility owners (NBA, NFL, City Convention Center Agencies, etc.) But external to such facilities, wireless carriers must build cell towers external to those venues on cell tower monopoles or surrounding building rooftops. Landlords of such locations tend to have strong negotiating positions with wireless carriers. However, to balance the equation as to not allow cell tower rental rates to be too high, wireless carriers have a lot of buildings to choose from as they balance between the need to lease the most “perfect” cell site locations against the need to pay the least rent for cell tower lease sites covering special venues.

Popular Locations

Popular locations can be places of interest, corporate campuses, national parks, university campuses, ocean beaches, nationally famous race tracks, marathon race routes, etc. These locations do not require the intensity of a special network such as malls and stadiums venues, but they get the same amount of attention from wireless carriers because while they serve fewer people than stadiums and convention centers, they are used more often. Wireless carriers and cell tower companies do want to provide great cell coverage at these locations. In order to provide the desired high-quality coverage, the natural place to lease space is inside of those locations. However, getting cell tower lease space at beaches, university campuses, and stadiums is extremely hard to accomplish. This is because these locations value security and aesthetics more than a few thousands of dollars a month in rent.

Highways And Freeways and Metro

One of the primary objective is to provide cell coverage for a growing population that now spends more time than ever in their vehicles. Carriers accomplish this by placing cell sites near freeways and highways that have the highest daily car count. Traffic congestions also play into site placements and designs, as traffic jams do cause a high volume of phone calls and data usage. Therefore, cell sites which meet carriers’ criteria of being adjacent to freeways and highways do enjoy a higher cell tower rent rate on average. However, being next to a congested road does not necessarily make the cell site a mobility site. Its placement will make the site more valuable. However, the fact is that these cell towers are almost never intended to provide cellular coverage for these small cities. They are designed to provide mobility coverage only for cell phone users traversing the highways and freeways. So the focus should be on the number of daily vehicles frequenting the stretch of highway, the importance of connecting the “smaller” town to the bigger city, and the importance of the smaller town (vacation destinations, large subdivisions, political influence, etc.) per the carrier’s marketing plan.

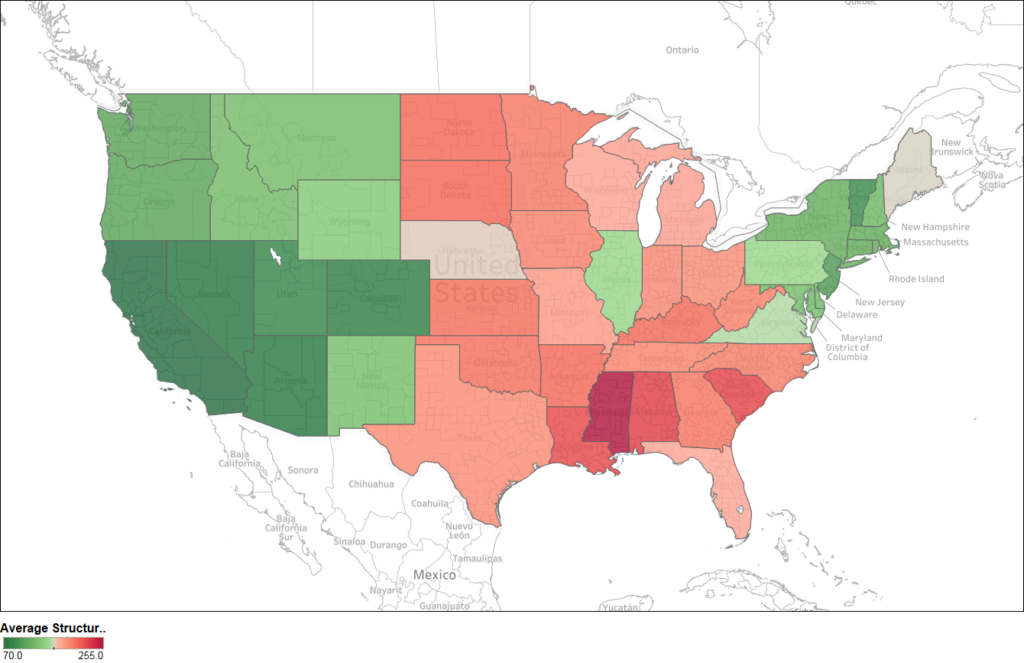

Average Structure Height by States

Proximity to Surrounding Sites Nearby

The very first assessment performed by CellWaves for our clients is reviewing the engineering design of the subject property to see how valuable and competitive it is to surrounding cell sites. Through this assessment, we have a good understanding of the importance of a cell site and whether a carrier would terminate the cell tower lease relationship due to increased rental costs. CellWaves’ database contains all cell towers across the country, their heights, azimuths, and through satellite imagery, GIS systems, and morphology, we are able to evaluate the wireless carrier’s RF engineering designs relative to a property address or latitude/longitude locations. Having a good understanding of how a particular cell site integrates well (or not so well) with the macro cell site design helps determine the value of a cell site to the wireless carrier. This, in turn, helps determine the value of a cell tower lease when assessing the monthly rental value of a site. Specifically, if your property location happens to be geographically central to the surrounding cell sites and has relatively good ground elevation relative to the neighboring cell sites, then there is no reason why a wireless carrier, or tower company such as Cr

own Castle, ATC, or SBA, should be demanding reduced rent. In fact, proper independent assessments of the cell site through evaluating their zoning, leasing, construction, and engineering alternatives will help determine an accurate monthly rental amounts for cell tower lease. Unfortunately, too many novice negotiators who have learned the business through real estate transactions do not understand the technology behind wireless communications will end up basing the future rent value by referencing old rent amounts. We believe mistakes made 25 years ago in setting too low of a rent amount should not be carried into the next 25 years. Independent assessment of what the site rent should be if it were to be built today should the test.

How Sophisticated is the Landlord

Site acquisition specialists are cautious around more sophisticated property owners because they do not want to offend him with statements or offers that may be summarily rejected. Every statement and offers are well thought out and has facts and data to support the site acquisition specialist claims in case he/she is challenged by the sophisticated landlords. In the world of wireless leasing, property owners who are lawyers, commercial real estate owners of large buildings or multi-buildings, corporations, and government entities are presumed to be “sophisticated” unless the are proven to be otherwise later. This group of people tend to have representation by real estate lawyers (who almost always lack technical skills in RF engineering) or industry-insiders with RF engineering, architectural, and leasing experience (CellWaves personnel). When this happens, the lease terms and rent rate offers tend to be more realistic at the beginning (instead of being “low-balled”) and the lease terms tend to be highly negotiated. Carriers have come to expect and accept this over the years, and have built in extra months of negotiations into their scheduling when the property owners are represented. Being represented by qualified technical lawyers or experienced industry-insiders almost always assure that property owners get the best cell tower rent rates and non-financial terms possible when compared to unrepresented landlords.

How Far from Expiration of Existing Lease

All leases have alerts built into the wireless carriers or tower companies’ databases that, at about five years before the lease expiration, the real estate department is notified to get the lease renewed. Wireless carriers tend to contract this work to vendors and bonus them for decreasing the rent or not paying any rental increases for the next 30 years. Tower companies tend to keep this work in-house, operated by a team of Leasing Specialists and a “Closer” who handles the paperwork.